Future Market Insights (FMI) forecasts that the global market for zero-sugar beverages will be valued at US$3,328 million in 2023. It is anticipated to accelerate, growing at a CAGR of 14.7% between 2023 and 2033. The global market is projected to reach a value of approximately US$ 13,150.6 million by 2033.

Premiumization has helped close the gap between upscale and mainstream markets. As a result, all customers can purchase unique and cutting-edge products.

Zero-sugar beverage producers may easily understand the advantages of premiumization. Nowadays, consumers are prepared to pay more for goods that offer value-added features and tangible advantages.

Zero-sugar beverage producers may easily understand the advantages of premiumization. Nowadays, consumers are prepared to pay more for goods that offer value-added features and tangible advantages.

Their trust in the brand name and clear labelling is growing. Leading manufacturers are focusing on enhancing consumer-facing items in terms of product quality.

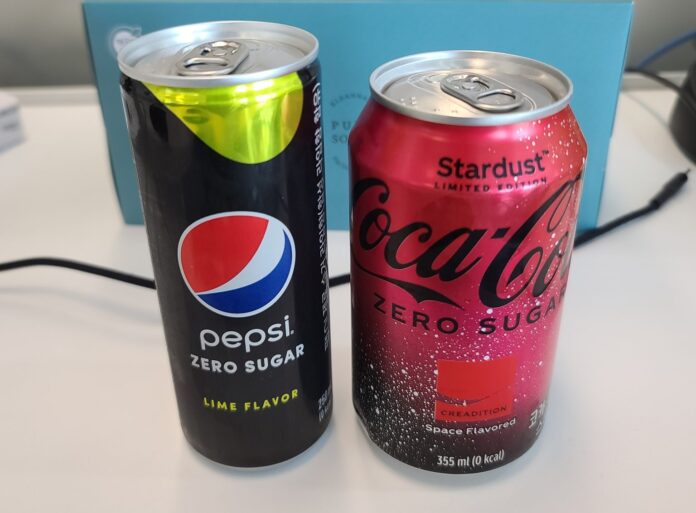

Modern customers can now find goods that meet their unique needs and preferences, whether it be for taste, convenience, or nutrition, thanks to the growing selection of zero-sugar beverages. Cola, orange, lemon, watermelon, guarana, grape, and strawberry are popular flavors in the zero-sugar beverage market. Beverages without added sugar are also offered in PET bottles, glass bottles, and cans.

Consumers are increasingly choosing beverages with all-natural ingredients and no added sugar. Additionally, there is a discernible trend toward the consumption of sugar substitutes and natural food additives.

Producers are developing goods with natural ingredient compositions and little processing to meet the rising demand for sustainable beverages. This is demonstrated by the labels on beverages that read “no added sugar,” “zero sugar,” “light,” and “diet,” which help customers make informed purchases.

Leading businesses frequently release novel items with distinctive flavors and advertise them as either “new editions” or “limited editions.” Even before the product is introduced, this marketing method creates consumer enthusiasm and expectation, which may help the product do better in the market.

For example, Coca-Cola launched a Grammy-nominated Marshmello-inspired limited edition zero-sugar Coca-Cola drink in June 2022. This new product featured a blend of natural flavors, including strawberry and watermelon. This approach allows companies to not only promote their brand but also generate interest in their latest offerings.

The United States zero sugar beverages market is projected to remain at the forefront throughout the forecast period. Several consumers in the country might have dietary restrictions that limit their sugar intake such as those with diabetes. Zero-sugar beverages provide a way for these individuals to enjoy a sweet drink without impacting their blood sugar levels.

Key Takeaways from the Zero Sugar Beverages Market Report:

- The zero-sugar beverages industry witnessed moderate growth at a CAGR of 12.5% between 2018 and 2022.

- Based on the sales channel, the retail sales segment is expected to hold the lion’s share in the evaluation period.

- North America is currently at the top in terms of the global zero-sugar beverages industry share.

- The global zero-sugar beverages industry is set to exceed a value of more than US$ 13,150.6 million by 2033.

- By product type, the sparkling soft drink category is anticipated to generate a leading share by 2033.

Category wise Insights

Which is the Highly Preferred Sales Channel for Purchasing Zero Sugar Beverages?

- Online Retail to be a Key Sales Channel for Buying Sugar-free Drinks Worldwide

- In terms of sales channels, the online retail sub-segment under the retail sales segment is anticipated to dominate the global market. Online shopping offers a convenient way to purchase zero-sugar beverages from the comfort of one’s own home, without the need to visit a physical store.

- Numerous online retailers also offer special deals and discounts on zero-sugar beverages. It can make them more affordable than in physical stores.

- A few online retailers provide subscription services for zero-sugar beverages. The strategy can provide consumers with regular deliveries of their favorite beverages at discounted prices.

Which is the Most Popular Type of Zero Sugar Beverage Across the Globe?

- Availability of Zero Sugar Soft Drinks in Various Unique Flavors to Accelerate Demand

- Based on product type, the sparkling soft drinks segment is anticipated to dominate the global zero-sugar beverages market in the assessment period. Millennial consumers nowadays enjoy the carbonation and fizzy sensation of sparkling soft drinks. It can provide a refreshing and enjoyable taste experience, thereby pushing demand.

- Sparkling soft drinks are available in a wide range of flavors, right from classic cola and lemon-lime to more unique flavors such as ginger or grapefruit. The variety of flavors can appeal to a wide range of consumers and their taste preferences.

“Consumers are expected to use plant-based sweeteners increasingly regularly, such as stevia and monk fruit. These offer a wholesome, calorie-free replacement for regular sweeteners. Additionally, the market is expected to see a surge in product innovation. Leading companies are preparing to launch new flavors and practical ingredients to appeal to consumers who are health-conscious.” – A lead analyst says.

Competitive Landscape

The competitive landscape is fueled by the presence of key national and international players. Leading Companies are implementing mergers & acquisitions and new product launches as key strategies to compete in the market.

Acquisitions and mergers have facilitated companies to improve product quality and expand product reach. Moreover, launching new products in the market has supported the companies to offer demanded quality products and meet the changing consumer trends across the industry.

Key Industry Developments:

- In February 2023, using 1 billion probiotics and prebiotics, Cove Gut Healthy Drinks introduced Cove Gut Healthy Soda. It is a sugar-free and functional soda. There are three flavors of Cove Soda: orange, grape, and lemon-lime. The product line, which is reportedly the first to hit the market in Canada, is manufactured with organic ingredients. It also includes a natural plant sweetener that mixes prebiotics with probiotics to improve gut health.

- In July 2022, a sugar-free cola-flavored drink was planned to be introduced by China-based beverage giant Genki Forest. The new beverage has passed its final internal tests and will go on sale as soon as the first of August, with an early release scheduled for online retail sites. This action indicates that the soft drink entrant will be competing with Coca-Cola and Pepsi’s premium product lines. The secret to this product is the development of an internal sterile carbonic acid manufacturing plant.

These insights are based on a report on Zero Sugar Beverages Market by Future Market Insights.