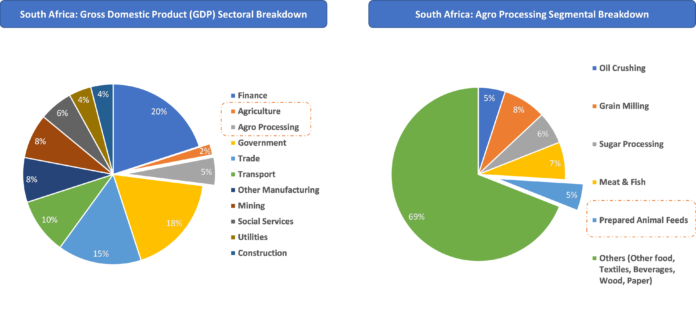

FIGURE 1 animal feed contribution to the south african economy, 2021

The feed industry in South Africa has a long history, which began in the 1930s, immediately after the great depression, and has become an essential economic activity in the country. In the last few decades, the country has witnessed a significant rise in per capita income, which has led to urbanization and an improved standard of living. Rapid growth in disposable income, coupled with globalization, resulted in an increase in meat consumption, in turn boosting the feed industry in South Africa. As the country witnessed a substantial increase in animal protein demand, the Animal Feed Manufacturers Association (AFMA) was established to optimize the future growth of animal feed with sustainable economic development.

According to the Animal Feed Manufacturers Association (AFMA), it has been stated that in 2019, the agriculture sector made up around 2% of the country’s Gross Domestic Product (GDP), while agro-processing added another 5% to the economy. Furthermore, prepared animal feed contributed 5% to the total output of agro-processing as of 2017. The prepared animal feed includes pet feed, feeds for farm animals and unmixed preparations of feeds for farm animals. This makes the feed industry one of the significant pillars of the South African economy.

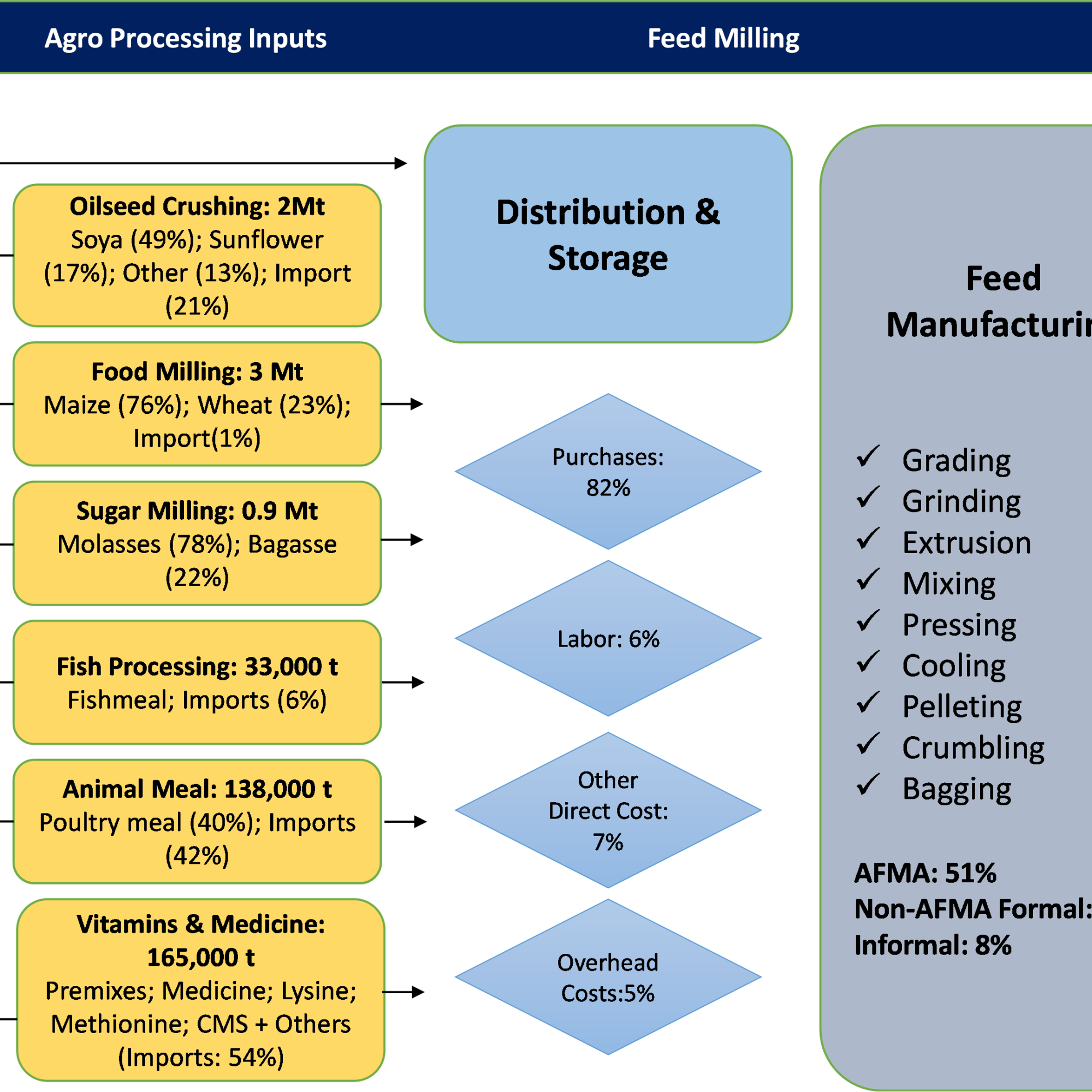

The animal feed mills of South Africa primarily source their raw material from the agricultural sector and agro-processing units. Major raw materials from the agricultural sector are oilseeds, corn, and other grains and dry material such as hay. Moreover, raw materials sourced from agro-processing units are oilcakes, grain millings, molasses & bagasse from sugar processing, and rendered animal meals. Additionally, a few products are also sourced mining sector, such as phosphates & limestone and from the chemical industry, including vitamins & medicines. These raw materials are processed to prepare tailored feed for poultry (broilers, layers, and breeders), cattle, beef, sheep, swine, equine, ostrich, and pets. This whole flow map becomes very important for understanding the overall feed industry of South Africa.

- FIGURE 2 PRODUCT FLOW MAP OF SOUTH AFRICA’S ANIMAL FEED INDUSTRY, 2020

Note: Mt indicates Million tons

Source: AFMA (2021), SAGIS (2021), the Protein Research Foundation (PRF, 2021), MarketsandMarkets Analysis

As urbanization, as well as globalization, is spreading across South Africa, the consumption of meat among consumers is also growing significantly. According to the data published in a report OECD-FAO Agricultural Outlook 2022–2031, the estimated consumption of poultry, beef & veal, swine, and sheep were 2,303 kilotons, 987 kilotons, 308 kilotons, and 180 kilotons, respectively, from 2019 to 2021. In addition, the same report has suggested that the growth rate for poultry, beef & veal, swine, and sheep meat from 2022–2031 would be 1.23%, 1.06%, 1.36%, and 0.33%, respectively. These statistics are witnessing promising growth for the feed industry in South Africa over the foreseeable future.

In recent years, South Africa has witnessed several challenges, including severe droughts and disease outbreaks. Despite the tenacious consumption of meat among all income groups in the country, a sudden outbreak of the pandemic, coupled with inevitable adverse climatic conditions, has slowed the meat demand. However, the feed industry has witnessed decent growth in recent years due to increasing spending on food, especially among the middle-class, robust demand for quality meat, and recovering tourism sector.

Since the animal feed industry is closely associated with the agriculture and agri-processing segments, South Africa needs to enhance their agricultural outputs and reduce their import dependence on the industry. However, in the last few years, local soybean and oil processing production has been ramped up, resulting in economical raw materials such as oilcake and meals supplied to the animal feed industry in the country. Overall, the outlook for the South African feed industry looks promising and is expected to witness decent growth in the coming years.

| Amit Gupta

Research Analyst – Food, Beverage, and Agri Email: amit.guota@marketsandmarkets.com |

Abhishek Dhar

Senior Research Analyst – Food, Beverage, and Agri Email: abhishek.dhar@marketsandmarkets.com |

| MarketsandMarkets Research Pvt. Ltd.

Website: www.marketsandmarkets.com |

|