In light of the global food scarcity and climate change trends, the farming community worldwide has been leveraging advanced practices that require the use of agricultural surfactants to improve the performance and effectiveness of crop protection solutions. When combined with agrochemicals, surfactants augment the spread of spray droplets on the surface of crops while improving the effectiveness of pesticides.

As countries worldwide ramp up their efforts to improve their agricultural yield and adopt the latest trends like off-season plant cultivation, the agricultural surfactants market outlook is likely to remain positive between 2022-2028.

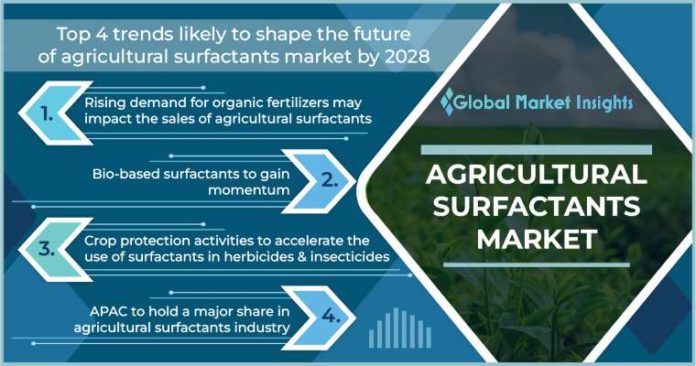

- Rising demand for organic fertilizers may impact the sales of agricultural surfactants

According to a survey by Phillips McDougall, the global sales of crop-targeted pesticides were $57.561 billion in 2018, 6% up year on year. However, increasing awareness regarding the ill effects of chemical pesticides and other agricultural chemicals could hamper agricultural surfactants businesses.

Consumers are now preferring food products that contain minimum chemical residues. The ongoing demand for organic fertilizers and pesticides is also impacting the sales of chemical pesticides. In consequence, this is influencing agricultural surfactants industry players to come up with organic products themselves.

As the adoption of bio-based surfactants and precision agriculture (PA) technologies to promote high-efficiency, low-input, and sustainable farming increases, the adoption of organic agricultural surfactants is likely to pick pace.

- Bio-based surfactants to gain momentum

The world is witnessing a pressing need to limit the use of chemical pesticides and other potentially harmful agrochemicals that could lead to environmental problems like lower potency of biodegradability, the toxicity of the soil, and so on. Having analyzed this scenario, agricultural surfactant companies are coming up with new bio-based surfactants that are mainly extracted from biomass such as cereals, vegetables, oilseeds, and waste materials.

These biosurfactants can support plant pathogen elimination and increase the bioavailability of nutrients for beneficial plant-associated microbes. They can widely be applied to improve soil quality by soil remediation and can replace harsh chemical surfactants that are presently being used in pesticide industries.

Related developments:

- In 2022, Swiss specialty chemicals maker Clariant unveiled its new Vita 100% bio-based surfactants and PEGs (polyethylene glycols) to directly address climate change by helping remove fossil carbon from the value chain. Developed for natural formulations targeting a high RCI (Renewable Carbon Index), the new Vita products support manufacturers in maximizing the bio-based carbon content of consumer goods such as crop formulations.

- In 2022, German specialty chemicals firm Evonik announced that it will be investing a million-euro sum for setting up a new production plant for bio-based and fully biodegradable rhamnolipids as the demand for environmentally friendly surfactants grows rapidly worldwide.

- Crop protection activities to accelerate the use of surfactants in herbicides & insecticides

Herbicides are often used in the agricultural sector to control the growth of unwanted plants like weeds. However, when blended with an agricultural surfactant, these chemicals increase the spraying ability of herbicides which helps farmers cover a much larger area at a time. Adoption of surfactants could thereby help increase workability while lowering the wastage of herbicides across farmlands.

Similarly, insecticides are another widely used crop protection method in the agricultural domain. These agrochemicals when mixed with surfactants can improve the crop protection ability against unwanted insects and pests. In the past few years, the demand for insecticides has increased substantially as farmers look to intensify their crop yield and limit the damage caused by pests. With the use of surfactants, they can ensure proper dispersal and spread of insecticides on crops that prove beneficial for crop protection and pest control.

As the agrochemical sector demands more innovative, sustainable crop protection solutions, companies manufacturing agricultural surfactants may depict lucrative growth prospects over the coming years. Evonik, for instance, has developed benign surfactants which support more eco-friendly plant protection that comply with eco-toxicological, safety, and sustainability criteria.

- APAC to hold a major share in agricultural surfactants industry

Agriculture continues to be a major occupation across Asian countries like China, India, and Bangladesh. These nations have a large population base and consequently are witnessing high demand for food grains and other produce. As the population across these nations is seeing an upward trend, agricultural surfactant companies could benefit considerably from this growing market.

According to a UN report, by 2023, India is projected to overtake China as the most populous country in the world. Given to such a scenario, farmers in the region are expected to steadily increase the use of agrochemical products that enable higher yield and eliminate issues like crop damage from pests and other diseases.

What does the agricultural surfactants market look like in the future?

An increase in consumer preference and demand for food products cultivated using organic solutions is likely to shape the future of the agricultural surfactants market, with an anticipated rise in sales of biosurfactants. Elevated focus on crop protection activities to mitigate damage caused by pests and crop diseases will open new business avenues for surfactant manufacturers.

Increasing population, mainly across Asian countries will compel the agricultural sector to ramp up its production capacity, thereby supporting new developments in agricultural surfactants in the future.

[…] Source link […]

Comments are closed.