The global food industry is undergoing a revolutionary transformation with the advent of cultured meat, a sustainable and innovative alternative to traditional livestock farming. As the global population hurtles from 7.3 billion to an anticipated 10 billion by 2050, the resulting surge in protein demand is poised to double existing production rates. The United Nations’ 2019 data emphasizes the pressing need to confront this imminent challenge. Recent figures from the Food and Agriculture Organization (FAO) in 2022 highlight a noteworthy escalation in global meat production, skyrocketing from 70.57 million tons in 1961 to a staggering 337.18 million tons in 2020. Against this backdrop of escalating demand, the environmental repercussions of traditional meat production emerge as a pivotal concern. FAO data reveals that 14.5% of human-caused greenhouse gas emissions originate from livestock farming, releasing not only carbon dioxide (CO2) but also methane (CH4) and nitrous oxide (N2O). This ecological impact intensifies the need to reassess conventional meat production systems, given their apparent lack of sustainability.

Recognizing the pressing need for sustainable protein sources, scientists have shifted their focus to inventive alternatives. Initial efforts predominantly concentrated on plant-based meat analogs, utilizing soy, wheat, or fungi-based proteins. However, recent years have witnessed a revolutionary turn towards cultured meat, also known as in vitro meat. This pioneering method involves creating meat analogs through in vitro cell culture technology, primarily utilizing skeletal muscle-derived cells sourced from biopsies. The inception of cultured meat dates to 2013 when Mark Post at Maastricht University successfully produced the first cultured meat using primary bovine skeletal muscle cells. This breakthrough marked the initiation of extensive exploration, with numerous university laboratories and companies, including noteworthy entities like Mosa Meat (Netherlands), Eat Just Inc. (US), and UPSIDE Foods (US) entering the burgeoning field.

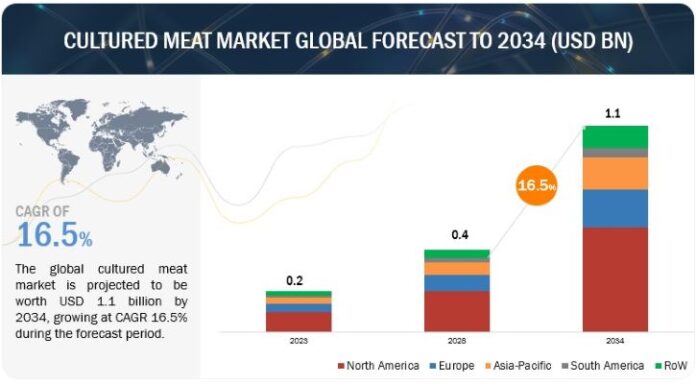

The following snapshot depicts the market forecast for cultured meat. It indicates that the demand for cultured meat is poised to rise significantly owing to growing awareness about animal welfare, surging demand for environmentally ethical food products, and rising food safety concerns associated with traditional meat consumption.

NORMAL SCENARIO: GROWING AWARENESS REGARDING ANIMAL WELFARE AND FOOD SAFETY CONCERNS CREATES OPPORTUNITIES GLOBALLY

Ongoing developments in biotechnology, tissue engineering, and cell culture techniques are accelerating the production of cultured meat, making it more efficient and cost-effective. Continuous innovation in this space is attracting investment and driving market growth.

This transformative wave propels the cultured meat market into a dynamic space where innovation aligns with sustainability, addressing the global demand for protein in an environmentally conscious and ethical manner. In exploring the trajectory of cultured meat, this article will delve into market dynamics, technological advancements, challenges, and the promising future of this evolutionary industry.

- technology related to cultured meat

Technological advancements in the cultured meat market have revolutionized the way meat is produced. Innovations in biotechnology, tissue engineering, and cell culture techniques have enhanced efficiency and scalability Improved cultivation methods, serum-free media formulations, and 3D bioprinting techniques are enhancing the development of high-quality meat analogs. These advancements not only contribute to the economic viability of cultured meat but also pave the way for addressing global food security and environmental sustainability challenges.

SCAFFOLDING TECHNOLOGY

Scaffold technologies facilitate the growth, proliferation, and differentiation of cells using edible, cost-effective, and sustainable materials and techniques. These cell-scaffold combinations can accommodate diverse processing strategies, encompassing structural approaches and additives to produce the final cultured meat products. An ideal scaffold should enable cell attachment, differentiation, and maturation in a defined manner, emulating the three-dimensional cellular arrangement found in meat, while allowing for the continuous flow of media, similar to the vascularization of real tissue. Therefore, considerations regarding scaffold porosity, mechanical characteristics, and biocompatibility are of utmost importance. In some instances, differentiated cells grown on edible microcarriers or alternative methods may be incorporated as blended additives in various non-structured products. However, fully replacing traditional animal-based meats necessitates the replication of structured items such as steaks, demanding the expertise of tissue engineers, materials scientists, and interdisciplinary researchers to develop methods for these applications.

3D BIOPRINTING

3D bioprinting involves the precise layer-by-layer deposition of living cells, growth media, and scaffold materials to build complex three-dimensional structures that closely mimic the composition and texture of traditional meat. This process starts with the isolation and propagation of animal cells, such as muscle cells, in a lab setting. These cells are then combined with a scaffold material, often made from edible or plant-based substances, which provides structural support. Using a 3D bioprinter, these cell-scaffold mixtures are deposited in a controlled and highly organized manner to create the desired meat structure. 3D bioprinting allows for the precise placement of different types of cells, enabling the recreation of the complex muscle tissue found in meat. It’s a promising technology in the cultured meat industry, as it offers the potential for customization of meat products, including texture, flavor, and nutritional content, and may play a significant role in meeting the growing demand for sustainable and ethical meat alternatives.

- Key Drivers Impacting the Growth

The cultured meat market is experiencing a significant surge in popularity and growth, driven by a rising global demand for sustainable and ethical food alternatives. This emerging industry is attracting substantial investments and innovative startups, with an expanding product range that includes beef, chicken, pork, and seafood. Market players are addressing consumer concerns related to taste, texture, and cost-effectiveness to make cultured meat a mainstream choice. As environmental and ethical considerations continue to drive consumer choices, the cultured meat market is poised for significant expansion, potentially revolutionizing the way humans produce and consume meat in the future.

Several startups are engaged in the development of cultured meat which include Mosa Meat (Netherlands), Memphis Meats (US), JUST, Inc (US), Integriculture (Japan), among others. These companies are focusing on innovation to reduce the price of the product and scale up production to increase the chances of its commercialization.

Investments by key industry giants – Investments by key industry giants are propelling the cultured meat market to new heights. Recognizing the vast potential of sustainable, lab-grown meat, major players in the food and technology sectors are injecting substantial capital into research, development, and production. This financial backing not only accelerates innovation but also enhances the scalability and commercial viability of cultured meat. Moreover, the involvement of industry leaders lends credibility to the sector, fostering consumer trust and acceptance. These investments are pivotal in driving the transition from a niche concept to a mainstream, eco-friendly, and ethical protein source, ensuring the cultured meat market’s continued growth and success.

In September 2023, Eat Just Inc. (US), announced a strategic partnership with Halal Products Development Company (HDPC), wholly owned by the Public Investment Fund of Saudi Arabia. Through the collaboration, HPDC would provide advisory solutions to help Eat Just obtain “Halal” certification and approvals needed to operate as a Halal food distributor. Similarly, in November 2022, Mosa Meat announced an agreement with Singapore-based Esco Aster that would eventually introduce Mosa Meat’s cultivated beef to Singapore. In May 2022, IntegriCulture Inc. (Japan) successfully secured USD 7 million in funding from a group of 12 investors during its Series A funding round, significantly bolstering its financial resources.

Rise in per capita consumption of proteins – The increasing demand for alternative proteins, rooted in changing consumer preferences and heightened awareness of sustainability and animal welfare, is set to propel the cultured meat market, as it offers a sustainable, ethical, and innovative protein source that aligns with these evolving consumer values.

The US Department of Agriculture’s authorization of the commercial sale and distribution of cultured meat from companies such as Good Meat and Upside Foods in 2023 has reignited international enthusiasm for food technology. This move positions the United States as the world’s second nation, following Singapore, to offer cultured meat products for purchase. This development holds significant advantages for the cultured meat market as it not only expands the market’s geographical reach but also signals increased regulatory acceptance, fostering investor confidence and potentially accelerating the adoption of lab-grown meat on a global scale. Furthermore, it provides a clear example for other countries and regulatory bodies, encouraging them to consider the regulatory framework for cultured meat, which can further stimulate industry growth and innovation.

Stringent regulatory environment – Cultured meat, because of the inherent novelty of its nature, is expected to face highly stringent regulatory scrutiny. Formulating meat in laboratories, though likely to yield positive outcomes in the interest of consumers and environmental stability, is expected to be minutely evaluated as meat continues to be a vital source of nutrients in recommended daily diets. This upcoming technology is being closely monitored by the United States Department of Agriculture (USDA) and the Food and Drug Administration (FDA). Companies in the US and Europe, engaged in the development of cultured meat, have to face lengthy regulatory approval procedures, which will affect the time taken for the commercialization of these products. Some European countries have mentioned cultured meat in the context of novel foods; however, they clearly indicate that current food industry regulations do not apply to the commercial production of cultured meat. Thus, cultured meat has a long way to go before commercialization, and regulatory hurdles further add to this delay.

Skepticism among consumers – Consumer perception is expected to play a key role in the acceptance of cultured meat. According to a survey titled, “Attitudes to In Vitro Meat,” by Matti Wilks and Clive J. C. Phillips, published in 2017, even though there are negative environmental and ethical concerns, the consumption of meat remains to have a positive outlook. Although there is an awareness of the risks associated with traditional meat production, the average consumer is unwilling to steer away from meat consumption. Consumer perception, which also includes price, plays a key role in this. Consumers are reluctant to pay more for cultured meat than they do for traditionally produced meat. There are also concerns about the taste and “naturalness” of cultured meat products. As per the findings of the 2020 study titled “Consumer Acceptance of Cultured Meat: An Updated Review (2018–2020),” consumers primarily associate cultured meat with benefits related to animals and the environment. While some consumers express concerns regarding the safety and nutritional aspects of cultured meat, others acknowledge the potential benefits in these domains. The research indicates that acceptance can be boosted through the dissemination of positive information and framing that evokes more favorable associations.

- value chain analysis

The value chain for the cultured meat market gives a more comprehensive understanding of the effective distribution of products to the end-user and stakeholders. It helps understand the market by recognizing the most valuable activities. The value chain analysis also helps understand the market for cultured meat and the relationship between stakeholders and their participation. The value chain for the market is highly integrated. It includes several activities, such as cell sourcing, cell cultivation, cell differentiation, tissue structuring, post-production processing, packaging, and distribution to the end users of the product, each of which is elaborated as follows:

Cell Sourcing – The value chain begins with the procurement of high-quality animal cells, typically through biopsy or cell lines from donor animals. The quality and type of cells obtained at this stage influence the final product’s taste, texture, and nutritional composition.

Cell cultivation – The cell cultivation stage is a pivotal step where animal cells are nurtured and proliferated to generate the foundational building blocks for meat production. This intricate process involves sourcing high-quality cells, often derived from muscle tissue obtained through biopsies or non-invasive methods. These cells are then cultured in a controlled environment, typically a bioreactor, where they receive precise nutrients and conditions conducive to growth.

Cell Differentiation– The cell differentiation stage in the cultured meat market value chain is a critical phase where specialized cells, typically skeletal muscle cells, undergo transformation into functional muscle tissues. Through precise control of environmental factors such as nutrient availability, temperature, and growth factors, scientists induce the cells to differentiate into muscle fibers, replicating the natural process of muscle development in animals. This stage is pivotal for achieving the desired texture, flavor, and composition of the final cultured meat product.

Tissue Structuring – In the tissue structuring stage of the cultured meat market value chain, cultivated cells undergo a transformative process to resemble the complex and organized structure of traditional meat tissues. Advanced tissue engineering techniques, including 3D bioprinting and scaffolding, play a pivotal role. Cells are layered and organized to replicate the texture, composition, and functionality of conventional meat. Precise control over cellular architecture ensures the development of muscle-like structures. This critical phase aims to achieve the desired taste, texture, and nutritional profile of meat products, contributing to the market’s quest for scalable and commercially viable cultured meat alternatives.

Post-production Processing– In the post-production processing stage of the cultured meat market value chain, harvested cultured meat undergoes critical processing steps to ensure quality and safety. This includes the removal of any remaining culture media and cellular debris, followed by flavor enhancement through the addition of natural ingredients. The texture and structure are fine-tuned to mimic traditional meat, and the final product is often formed into familiar cuts or shapes. Rigorous quality control measures are implemented to meet regulatory standards, and packaging is designed to preserve freshness. This stage is integral to delivering a consumer-ready, sustainable, and ethically produced alternative to traditional meat.

Quality control– Rigorous quality control measures are implemented to ensure the safety, taste, and nutritional value of the cultured meat products meet or exceed consumer expectations. Advanced analytical techniques assess cell viability, microbial contamination, and nutritional profiles. Stringent quality control measures guarantee that cultured meat products meet high standards, fostering consumer confidence in this innovative and sustainable alternative.

Packaging and Distribution– Cultured meat is packaged using eco-friendly materials, minimizing environmental impact. Cold chain logistics maintain freshness during transportation, guaranteeing consumers receive a sustainable and ethically produced alternative to traditional meat with optimal quality and safety standards upheld throughout the supply chain.

The market mapping of the ecosystem is categorized into demand-side and supply-side companies. The demand side of the cultured meat market encompasses a wide array of participants, including individual consumers, restaurants, retailers, and institutions. Consumers are the primary driving force, with increasing numbers seeking sustainable, ethically produced, and healthier protein sources. This demand has led to the involvement of various advocacy groups and organizations that promote the benefits of cultured meat and raise awareness about its positive environmental and ethical impacts. Restaurants and foodservice providers are responding to the growing consumer interest in alternative protein sources by adding cultured meat products to their menus. Retailers are offering these products on their shelves, responding to the shift in consumer preferences. Overall, the demand side of the cultured meat market comprises diverse stakeholders, all contributing to the growing interest and acceptance of this innovative food source.

The supply side of the cultured meat market involves a diverse array of stakeholders. Primary contributors include research institutions and universities pioneering advancements in cell culture technologies, biotechnology companies developing scalable production methods, and startups spearheading innovation in cultured meat production. Additionally, regulatory bodies play a crucial role in establishing guidelines for safety and labeling. Investors and venture capitalists support the market through funding, while traditional meat industry players may also become stakeholders as they explore or integrate cultured meat into their production portfolios. This intricate network of stakeholders collectively shapes the growth and development of the cultured meat market.

The snapshot below depicts the ecosystem of the cultured meat market comprising producers, research institutions, raw material providers regulatory bodies, and certification providers. Producers, ranging from startups to established companies, lead innovation. Research organizations contribute to technological advancements. Raw material providers are involved in the manufacturing and supply of growth media and growth factors. Regulatory bodies establish standards.

- way forward

In conclusion, the cultured meat market stands at a crucial juncture, with significant advancements and challenges shaping its trajectory. The production of small-scale cultured meat products of edible quality is on the horizon, yet achieving price competitiveness remains uncertain. Large-scale production poses substantial challenges, particularly in the development of cost-effective culture media. The industry faces semantic ambiguities, and societal acceptance remains a complex variable. The social, political, and economic implications of a flourishing cultured meat sector necessitate ongoing critical analysis. While start-ups currently dominate funding, resilience in the face of potential market fluctuations is crucial. Economic viability alone may not ensure the delivery of altruistic or environmental benefits, urging stakeholders to remain attentive to achieving the industry’s projected positive outcomes. As a pivotal technology, cultured meat offers potential solutions to environmental and food security challenges, but a comprehensive, multi-faceted approach is essential, recognizing the systemic nature of contemporary food systems. The future hinges on interdisciplinary research and a nuanced understanding to foster robust socio-technical responses and drive sustainable market growth.