Sales fell in last year’s closing balance for all major types of agricultural machinery. The market downturn, which is partly technical after the boom in 2021, is also due to the well-known supply problems and high raw material prices. Demand for machinery, however, remains high, thanks to government incentives. Allocations for agricultural machinery under the NRRP are in the pipeline.

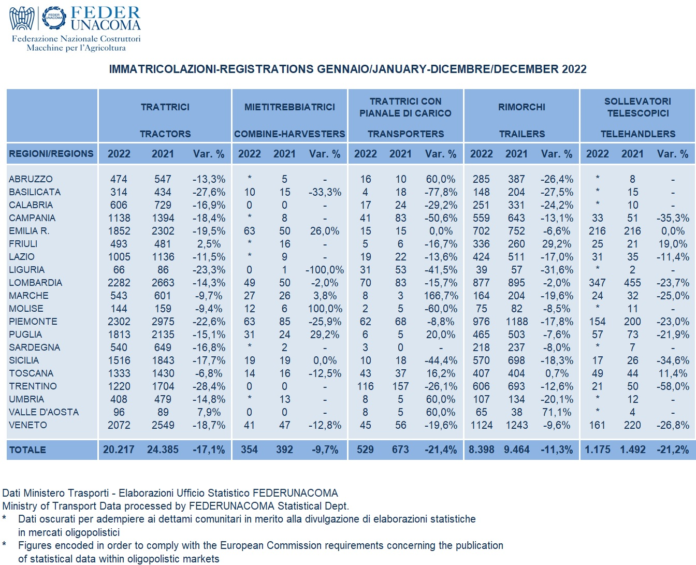

Problems in the supply chain, sharp rises in raw material prices and uncertainties in the geopolitical landscape affect the performance of agricultural machinery, which closes 2022 with a drop compared to the record growth of 2021. The statistics on registrations, processed by FederUnacoma on the basis of data provided by the Ministry of Transport, indicate a contraction for all the main categories of vehicles, starting with tractors, which dropped 17.1%, with 20,217 registered units. The downturn in sales penalised above all medium and medium-high horsepower machines, concentrating in particular on the 56 to 75 horsepower segment which, with a total of 4,354 registered units, fell by 43.7% on 2022.

On the other hand, a counter-cyclical trend characterised the low horsepower ranges. While the 19 to 56 horsepower ranges (5,034 vehicles sold) basically confirmed last year’s volumes (-2.9%), the power ranges up to 19 horsepower improved on 2021 volumes (+26.2%) with 1,061 registered tractors. As for the other types, the closing balance was also in the red for combine harvesters (-9.7%), with 354 registered machines, and for telehandlers, which, with 1,175 registrations, fell by 21.2% compared to last year, interrupting a phase of growth that had been going on uninterruptedly since 2019. Flatbed tractors and trailers also followed the market trend: the former closed the year with a loss of 21.4% (529 units registered), the latter with a drop of 11.3% (8,398 units).

The market contraction, on which the well-known economic factors have undoubtedly weighed, can be considered partly organic, i.e. a “technical” drop after the extraordinary trend seen in 2021 (+35.9% for tractors, +29.8% for combine harvesters, even +56% for telehandlers). Even in 2022 – FederUnacoma explains – demand for agricultural technology remained at high levels, benefiting, among other things, from public incentive tools for the purchase of machinery.

A comparison between the past twelve months’ figures and the average sales trend over the last five years shows a positive balance for tractors, combine harvesters and telehandlers. Prospects for 2023 are still linked to the trend of cyclical variables, from the price of raw materials to logistics costs and developments in the Russian-Ukrainian conflict, but the Italian market – adds the manufacturers’ association – will also be weighed down by the additional funding measures that the government is implementing right now with the agreement of the State-Regions Conference on NRRP allocations for innovation in the agricultural machinery sector, for which an organic plan is needed.

Moreover – FederUnacoma concludes – the NRRP, which alone is insufficient to cover the national need for agricultural technologies, should be suplemented by a reiterable measure expressly earmarked for agriculture 4.0 and the purchase of innovative and sustainable mechanical equipment.