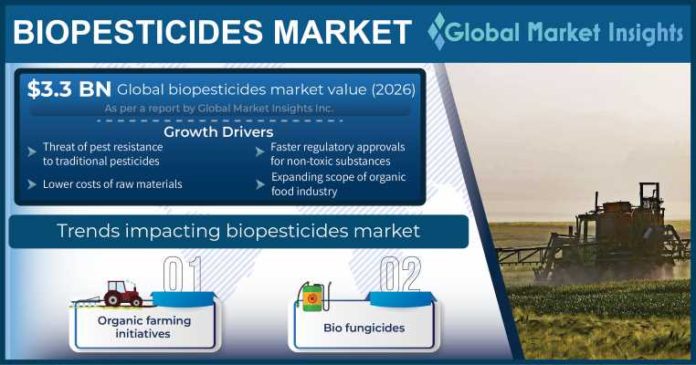

Owing to such benefits, biopesticide businesses are speculated to foresee substantial growth over the coming years, as organic farming continues to make progress. A new report by Global Market Insights Inc. estimates the global biopesticides market value to surge beyond USD 3.3 billion by 2026.

Biopesticides industry is poised to see a steady expansion worldwide, with robust demand for organic food. The recent years have seen the global population ask for food and other consumables that are produced in an ecologically responsible way, without compromising on the quality. This paradigm shift in attitude and awareness has offered a prolific growth for organic farming.

Farmers worldwide have begun embracing new solutions for cultivating crops without hazardous and toxic substances. According to the UN Food and Agriculture Organization as of 2021 there was nearly 72.3 million hectares of organically managed agricultural land cultivated by around 3.1 million producers globally. If more farmers seek to switch to organic farming while maintaining the health of their crops, the agriculture industry is projected to call for innovative organic solutions.

Organic farming initiatives scaling the production and sales of biopesticides

- Investments and practices in organic farming in Africa Biopesticides Market

Organic farming has great potential throughout the African continent but is currently at a nascent stage across different economies. A data from the Research Institute of Organic Agriculture revealed that just 0.2 percent of Africa’s farmland was organic during 2020. This presented huge opportunities for investments and initiatives in the field, paving way for the adoption of biological pesticides.

In 2021, Rwanda announced establishing a partnership with Ghana to develop a chocolate plant and other key manufacturing units. A part of the deal is to build a formulation unit in Ghana to make organic pyrethrum-based pesticides for veterinary use, crop protection, and public health. The initiative would cut the transportation costs and bring affordable organic products closer to the Ghanaian farmers.

- DEFRA and UK Research & Innovation partnership

In the UK, during 2021 the Department for Environment, Food, and Rural Affairs announced a partnership with UK Research and Innovation for funding worth nearly USD 22 million. The initiative was aimed at the research and development via an industry-led R&D Partnerships fund, the first of three to open in the Farming Innovation Program. According to UKRI official sources, the program would support ambitious R&D projects to bolster the environmental sustainability and productivity in England’s horticultural and agricultural sectors.

This would also help them accomplish their net-zero ambitions. With the demand for reduced carbon emissions escalating in the country, the need for biopesticides for pest control is expected to soar considerably over the coming years.

Bio fungicides: What and why?

A Michigan State University report cited that fungal pathogens are primary cause for 85% of the plant diseases worldwide, compromising the crop health and the food quality. This has left global farmers worried and they demand a fungicide solution that could both eradicate the disease spread and at the same time, add to the environmental sustainability goals. Enter- Bio fungicides.

Bio fungicides are generally used in agriculture to control diseases caused by fungi. These are technologically advanced, an effective and safe alternative to some of the traditional synthetic fungicides. In fact, modern-day agriculture has raised calls for new biological solutions to control diseases that affect crop health, paving way for an increased sale of bio-fungicides.

Some of the prominent reasons why bio fungicides are being preferred include:

- These offer natural protection for crops and contribute to improving the harvest yield and quality.

- Useful for resistance management in the crop.

- High compatibility with integrated management programs for control of diseases caused by bacteria and fungal diseases.

- Utilizing bio fungicides in integrated management programs across the agriculture industry, in addition to some chemical products, could potentially reduce the levels of residues in foods.

The growing trend of organic farming has indeed pushed the growth of bio fungicide businesses worldwide, enabling different biopesticides market leaders to consider expanding their portfolio. For instance, AgBiome Innovations International AG in 2021 declared a commercial supply agreement with FarmHannong Co for the expansion of its Howler bio fungicide folio in Asia.

In yet another instance, UPL- a chemical industry firm- announced the acquisition of OptiCHOS, a biological fungicide. This move is claimed to strengthen the company’s Natural Plant Protection business unit. The fungicide provides a low-risk, new, and bio-degradable broad-spectrum disease control solution to farmers, with low human and environmental impact. The product represents how producers are keeping in mind the evolving agriculture needs, which invariably become parallel to global climate concerns.

While the organic food market is just massive, the supply is still lagging far behind due to the exploding population and increasing food demand. One of the primary factors holding back the organic agricultural production has been the unwillingness of farmers in some economies to take up a lucrative but potentially risky option. However, with the introduction of inexpensive and effective biopesticides like bio fungicides, agriculturists could opt for more promising solutions. A switch to biopesticides would allow the agri-food industry to reap healthier, more ecologically responsible yields with reduced risk, while meeting modern consumer demand.

Source: https://www.gminsights.com/industry-analysis/biopesticides-market