Ensuro, in collaboration with climate insurtech experts Ibisa and microfinance specialists Fortune Credit, has developed a weather product called “ResilientGrowth” to support Kenyan farmers in dealing with climate change.

What is “ResilientGrowth”?

Our innovative product provides coverage in the absence of rainfall during the seeding period, helping Kenyan farmers to protect their investment and build resilience against drought.

Kenyan farmers face numerous challenges caused by climate change. Drought and crop losses result in food insecurity. Traditional agriculture insurance solutions are not widely adopted in this market due to negative perceptions and limitations including high costs, inefficiencies, and distribution challenges. Operational costs and low margins of microinsurance products for farmers have prevented the development of commercially viable solutions, leaving the responsibility to foundations and not-for-profits organizations.

Smart contracts paired with parametric insurance offer new possibilities. Our product leverages the Polygon blockchain to automate the policy trigger and execute payouts. This solution cuts operational costs and allows inexpensive microtransactions, being both affordable for the policyholders and profitable for the providers. Benefits include swift, efficient, and transparent compensation, scalability, affordability, and a replanting guarantee. Blockchain technology ensures transparency, security, and efficiency in payment management, eliminating the risk of misuse and fraud. By using blockchain technology, Fortune Credit offers a level of accountability unmatched by traditional insurance products.

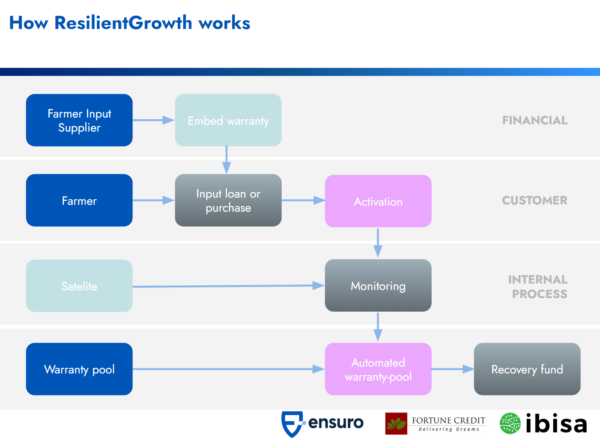

Fortune Credit is piloting the solution in Bungoma County, where farmers apply for loans to fund their warranties and activate them through a unique code. Fortune Connect monitors the warranty and triggers compensation where needed. The solution involves the distribution of farm input warranties through seeds, fertilizers, and agrochemicals. Farmers pay a subscription fee, embedded in the selling price of inputs, and activate their warranty through a USSD code shared with every input. The system uses satellite monitoring of farmers’ fields to trigger compensation if their land receives less rainfall than defined thresholds.

ResilientGrowth covers specific periods, during which lack of precipitation is considered a peril. The coverage is based on an index value calculated by adding the precipitation amount in millimeters during the specified period. The index triggers are computed for three sub-districts, and payouts are made based on the severity of the drought, with a 70% payout for critical drought, 30% payout for severe drought, and 20% payout for moderate drought.

Ensuro’s role

Ensuro offers to its partners competitive pricing, speed and transparency. With support from Ibisa’s microinsurance expertise, Ensuro assisted Fortune Credit in launching “ResilientGrowth” to help farmers seeking protection against weather volatility.

Acting as an intermediary between liquidity providers and MGAs, Ensuro leverages digital assets and smart contracts to offer underwriting capacity that is more efficient than traditional reinsurers. Following in the footsteps of Koala and Parachute programs, Fortune Credit has chosen to leverage USDC stablecoins to capitalize its product.