According to the dictionary, a paradox is “a statement or proposition that, despite sounds reasoning from acceptable premises, leads to a conclusion that seems senseless, logically unacceptable, or self-contradictory.”

THE GLOBAL AGRO-PARADOX

It is commonly known and agreed that a business’s potential is more significant when it operates in a large market versus a small one. Hence, companies and businesses invest many efforts to access larger markets.

Related to agriculture, three major groups are active; Farmers, Value chain (including supply), and Consumers.

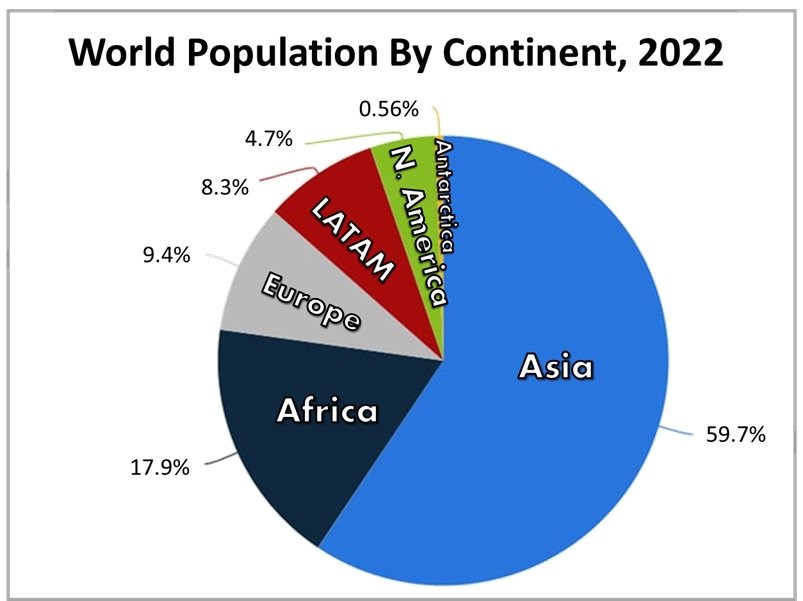

If so, how do farmers in a tiny country like Israel thrive while those in mega-markets like Africa, India, and China live in poverty?

Is it a miracle or a paradox?

And one other thing, why do agro-tech and agro-chemical companies choose to focus their business and R&D efforts on professional farmers in the Global North, though they only make up 3% of the total global farmers?

Don’t they know where most farmers are, or is it part of the paradox?

Those questions stand at the base of the Global Agro-Paradox.

What do you think is the source of this?

Is it due to discrimination, racism, colonialism, lack of support, or inability, or is it something else?

THE CYCLES OF WEALTH

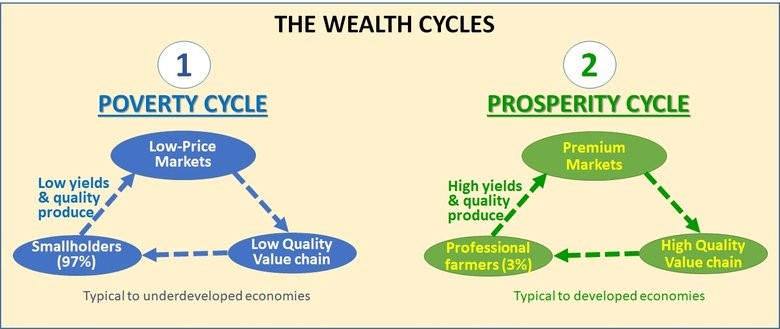

It may seem the world is one, but in terms of agriculture, it operates under two separate value chains (Figure 3) – the Poverty Cycle and the Prosperity Cycle.

The MARKET of each Cycle predetermines the economic outcome and the financial state of its other parts, i.e., value chain partners and farmers.

The two Wealth Cycles work separately, with no links or sporadic ones connecting them.

Poverty Cycle (1) is typical of underdeveloped economies. In those countries, farmers sell low-quality produce and have access to low-price markets. This produce is grown and marketed with the support of a broken low-quality (and price) value chain that supports farmers growing low-quality and low-quantity production.

The Prosperity Cycle (2) is the (opposite) mirror reflection of Cycle 1. It is typical to developed economies, where farmers cultivate and market high-quality and high-quantity produce, have access to premium markets, and are supported by a high-quality value chain.

The presented situation demonstrates the Global Agro-Paradox, which in practice results from two Wealth Cycles that exist and act separately, with extreme switching barriers.

Consumers switch Cycles when they become more/less wealthy. However, Farmers and Value Chain partners are predesigned to serve one type of Wealth Cycle. For farmers and the value chain, switching Cycles is nearly impossible.

Here are two examples, taken from my experience, presenting the point of view of a farmer and an agrotech company (i.e., value chain) –

Example 1; As a professional Israeli farmer with high yield and quality but also with high production costs, I wouldn’t be able to compete with African small-farm holders in the low-price markets. As a farmer, I can’t switch Wealth Cycles.

Example 2: As an Israeli AgroTech entrepreneur, the costs of R&D, production, etc., are high. When I arrive with my top tech quality solutions to Africa or other underdeveloped economies, farmers who sell little yield to low-price markets can’t afford to buy my solutions, even if everybody agrees the results are better. As an entrepreneur/businessperson, I can’t switch Wealth Cycles.

It explains why farmers in underdeveloped economies advance slower than we would expect and hope despite extreme efforts.

It also explains why Global North AgroTech companies don’t and can’t work in the Global South once they have developed their business model and found their place in the value chain.

The same goes for the Global South farmers. They are part of the Poverty Cycle, so switching to the Global North Prosperity Cycle and selling to Premium markets is often beyond farmers’ and value chain ability.

The inability to easily switch Wealth Cycles dictates that those born poor will likely (and most unfortunately) die poor, and their children will follow the same path. And vice versa for those who are born rich.

Meaning that people’s wealth is dictated by something they can’t influence – the place of birth.

It’s depressing, but is it also hopeless?

Switching between Wealth Cycles is difficult, for it requires simultaneously applying many significant changes, including; attitude, ecosystems, technologies, services, etc.

But we can only begin with those changes once we have a sustainable business model to energize (finance) those.

So the first step is having a newly developed business model dedicated and designed for these situations (which is why the IBMA conference is a MUST for you).

Do you see that it is not a matter of laziness or lack of interest that farmers in the global south have difficulty improving their income and agrotech companies avoid entering these markets?

It is all about Wealth Cycles.

FIXING THE GLOBAL AGRO-PARADOX

Fixing the Global Agro-Paradox is a grand challenge yet to be overcome.

The typical current way to approach this is by providing farmers with subsidies (money/funds), technologies, and services. For example, the AGRA program invested $ 60B over 15 years in this direction. Unfortunately, they failed.

So what do we do? Should we agree this is an impossible mission and leave things as they are?

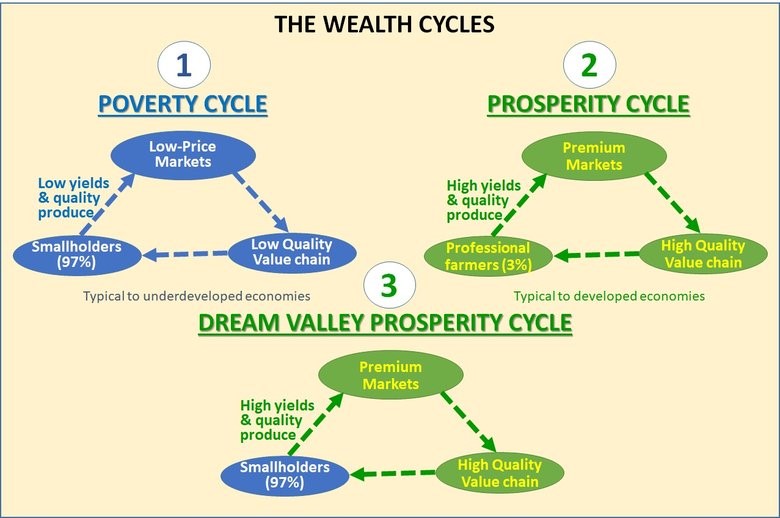

Well, there may be a way. If we look again at Figure 3, we see that by merging drawing 1 and 2, we can create a new Cycle where smallholders replace the Professional farmers, as presented in Figure 4.

Such operation connects farmers to the vital “organs” in the Prosperity Cycle, injects “new blood” into the value chain, and provides them with a fair chance of success.

This is a “reverse hurt transplant” where we work to save the hurt, i.e., farmers. Keep in mind that in many underdeveloped economies, the rate of farmers in the population is 50% to 80%!

Those economies struggle to lift themselves under the heavy weight of farmers’ poverty, and for decades they fail. A poor agro sector leads to a poor national economy.

The “merging” of Cycles, as presented in Figure 4, clearly can’t be done at once. Not with all farmers and all crops at once.

But we can do it in steps; in a limited area, with a limited number of farmers, and starting with one crop. Then, when everything works well, we can scale up the operation.

To transform small-hold farmers from the Poverty Cycle to the Prosperity Cycle, we need to provide them with the proper tools, which include, among others, a high-quality value chain, access to premium markets, and the business model to energize the entire Cycle.

When you follow path 3, the Dream Valley Prosperity Cycle, you stand an excellent chance to achieve a long-lasting transition to an economy of prosperity. This is most relevant to countries where the livelihood of over 50% of the population depends on agriculture, e.g., many countries in Africa, Asia, and LATAM.

When appropriately applied, farmers and the country can rapidly improve their business results and the current and future living conditions.

Is this possible?

How many years should such a transition take (3, 5, 20, 100)?

THE DREAM VALLEY PROSPERITY CYCLE

For many years, I have been testing, experimenting, and applying parts of the Dream Valley Prosperity Cycle, each separately, like an orchestra conductor who listens and tries each instrument individually.

But as in an orchestra, hearing each instrument separately does not give the combined effect obtained only when all the instruments play together.

In 2021 I was about to let many “instruments” of the Dream Valley Prosperity Cycle play together and, for the first time, see its impact, and Senegal was the best place to do that.

We focused on the most challenging parts – the farmers and the value chain partners from the farm to the packing house.

We knew that once we have the right export quality products, the shipping and marketing to premium markets, i.e., Europe, is technical, and we excel in doing it. So we focused on the stages from the farm to the packinghouse.

In the spring of 2021, Dream Valley applied its Prosperity Cycle concept in a national-like model in Senegal. This was yet another “small step” towards achieving Dream Valley’s global vision.

We did it in a limited area with one crop – mango, over a limited area – of 2,500 hectares and a limited number of farmers – a few hundred.

The goal: Helping farmers produce export-quality fruits and get them in the packinghouse ready to export. If this was an orchestra, what we did was orchestrate the most challenging instruments in the orchestra and listen to the overall sound; would it stand to our expectations?

We measured “The Impact” relative to the norm of farmers’ income per hectare ($/€) and national mango export to premium markets (kg/tons).

This was like playing together the most challenging instruments in an orchestra, waiting to see/hear the overall impact

2021 Senegal result:

FARMERS – doubled or near doubled their income per hectare from the € 500 benchmark (testimonies).

NATIONAL MANGO EXPORT – doubled, reaching a maximum of over 24 million kg from the 12 million kg benchmark (before and after 2021).

Question: Can we overcome the Wealth Cycle barriers?

Answer: It is in no way easy or simple, but it is possible. Global South farmers can sell to premium markets, and Global North agrotech, i.e., value chain companies, can work in the Global South.

Dream Valley’s national-like model also proved that this could be a highly profitable endeavor.

Dream Valley doubled Senegal’s mango exports and its growers’ income in less than a year.

Critical Note. Mangos produced under the Dream Valley protocol received ZERO pesticide sprays, ZERO fertilizers, or any other chemical in the field. And the quarantine pests interception, particularly fruit flies, in 2021 was the lowest in many years (see the post by Dr. FAYE).

No sprays and no infestation by bio-security hazards open a new era for fruit exports. Add to this an export increase of 200%. To this moment, I can’t believe it happened. Good, there are reports by TV stations, newspapers, farmers, national export reports, and experts.

Only one year.

Imagine what Dream Valley can do over a more extended period with the farmers of your country.

GLOBAL-SCALE

The 2021 model in Senegal presents endless opportunities that are now open for underdeveloped economies, their farmers, business people, investors, and other stakeholders.

This is the beginning of an era of long-term prosperous-economic possibilities for all involved.

By applying proper models, African, Asian, and LATAM countries can do more to agriculture than China did to manufacturing, as it will significantly improve farmers’ lives.

It’s time to empower 97% of farmers, small-hold farmers (60% women), and the agro sector in underdeveloped economies.

In 2021 Dream Valley moved from an Orchard-scale to a regional/national-scale, and it’s now time to take it GLOBAL.

We all know the first who invested in Amazon, Google, Facebook, Spotify, and Tesla. We remember those investors/companies investing in China after it opened its gates.

Everybody thought they were crazy. But they proved everybody wrong. They were the first; they benefited hugely and gave the world something to remember.

Dream Valley will be the most significant fruit trader from Africa, Asia, and LATAM to Premium Markets.

This is for you if you are an investor, a visionary business person, or a company looking to broaden its horizons.

Dream Valley began fundraising. We are looking for experienced investors with involvement and readiness to impact the global agro sector like never before and be “the Amazon Plus” for farmers in underdeveloped economies.

Message me if this resonance with your abilities, ambition, and vision of the future of the world food growers and consumers. WhatsApp (text) +972-542523425