The revenue from the global glyphosate market was estimated to be approximately US$ 6,047.9 million in 2023 and is anticipated to reach US$ 8,883.3 million by the conclusion of 2033. Sales revenue is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.8% over the forecast period (2023-2033). Over the last few years, the glyphosate market recorded sales of US$ 4,715.0 million in 2018, with revenue expanding at a 3.5% value CAGR, eventually reaching an approximate valuation of US$ 8,883.3 million by the end of 2033.

Glyphosate, also known as N-(phosphonomethyl) glycine, stands as one of the world’s most extensively used broad-spectrum herbicides. Glyphosate herbicides are commonly employed in agriculture due to their simplicity and cost-effectiveness in controlling persistent weeds. Primarily utilized in agriculture, glyphosate products find application in various crops such as cereals, grains, pulses, fruits, vegetables, tubers, and others. They effectively target weeds like chickweed, barnyard grass, dandelion, among others. Consequently, the demand for glyphosate is on the rise globally, with a growth rate of 4.8%.

It’s worth noting that this information is provided based on research conducted by Persistence Market Research.

Key market growth factors:

Cost-effectiveness: Glyphosate offers a cost-effective solution for weed control compared to alternative methods such as mechanical weeding or other herbicides. This affordability makes it an attractive option for farmers, especially in regions where labor costs are high.

Broad-spectrum effectiveness: Glyphosate is a broad-spectrum herbicide, meaning it can effectively control a wide range of weeds in various crops. Its versatility and efficacy against different types of weeds make it a preferred choice for farmers globally.

Increased adoption in agriculture: With the expansion of agricultural activities to meet the growing global demand for food, the use of glyphosate has surged. It is extensively utilized in major crops such as corn, soybeans, wheat, cotton, and others, contributing to its market growth.

Ease of application: Glyphosate-based herbicides are easy to apply and can be used in various application methods such as spraying, spot treatment, or through genetically modified crops that are glyphosate-resistant. This ease of application enhances its appeal to farmers, simplifying weed control practices.

Market Restraints

Regulatory challenges: Glyphosate has been the subject of intense regulatory scrutiny due to concerns about its potential environmental and health impacts. Regulatory agencies in various countries have imposed restrictions or bans on glyphosate use, leading to market uncertainty and hindering its growth prospects.

Emergence of herbicide-resistant weeds: Prolonged and extensive use of glyphosate has resulted in the development of herbicide-resistant weed populations. These resistant weeds pose a significant challenge to effective weed control and may necessitate the use of alternative, more expensive herbicides or weed management strategies, impacting the demand for glyphosate.

Public perception and consumer preferences: Growing awareness among consumers about the potential health and environmental risks associated with glyphosate has led to shifting preferences towards organic and sustainable agricultural practices. Negative public perception and consumer preferences for glyphosate-free products could reduce demand for glyphosate-based herbicides, affecting market growth.

Opportunities

R&D Investments: Increased investments in research and development can lead to the development of safer and more environmentally friendly formulations of glyphosate-based herbicides. Innovations in formulation technology can enhance efficacy while minimizing environmental and health risks, opening up new market opportunities.

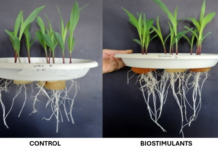

Bio-based alternatives: The growing demand for sustainable agricultural practices presents opportunities for the development and commercialization of bio-based alternatives to glyphosate. Bioherbicides derived from natural sources offer potential solutions for weed control while addressing concerns about chemical residues and environmental impacts.

Precision agriculture: The adoption of precision agriculture technologies, including GPS-guided machinery, drones, and remote sensing, provides opportunities to optimize glyphosate application and minimize waste. Precision application techniques can improve weed control efficacy, reduce input costs, and mitigate environmental impacts, enhancing the value proposition of glyphosate-based herbicides.

Top Regional Markets

Glyphosate sales in Italy are projected to reach US$ 48.9 million in 2023, with the market expected to grow by 2.0% throughout the forecast period. This growth is attributed to the increasing adoption of glyphosate within the European agriculture sector for weed control, which is contributing positively to market expansion.

Regarding the consumption growth rate of the glyphosate market in Mexico, it is anticipated to experience a moderate increase. Persistence Market Research suggests a Compound Annual Growth Rate (CAGR) of 3.5% over the forecast period. This growth is driven by the growing demand for liquid glyphosate, particularly for crop protection purposes, indicating a favorable trend in the Mexican market.

“Expansion of the Horticulture Industry in Latin America Boosting Glyphosate Sales”

In Mexico, the glyphosate market is expected to witness steady growth, characterized by a CAGR of 3.5% over the forecast period. This growth is primarily attributed to the escalating demand for liquid glyphosate for crop protection purposes. The expanding horticulture industry in Latin America further propels the sales of glyphosate, indicating promising prospects for market growth in the region.

Key Recent Developments

Regulatory Changes: Ongoing regulatory developments have impacted the glyphosate market. For instance, in certain regions, there have been updates to regulations governing the use of glyphosate, including restrictions on application methods, permissible concentrations, and labeling requirements. These regulatory changes have prompted manufacturers to adjust their product formulations and marketing strategies to ensure compliance.

Emergence of Bio-based Alternatives: With increasing concerns about the environmental and health impacts of conventional glyphosate-based herbicides, there has been a growing interest in bio-based alternatives. Recent developments in biotechnology and organic chemistry have led to the emergence of bioherbicides derived from natural sources, offering safer and more sustainable weed control solutions. Manufacturers are investing in research and development to commercialize these bio-based alternatives and capitalize on shifting consumer preferences.

Litigation and Legal Proceedings: Glyphosate manufacturers have faced legal challenges and litigation related to health and environmental concerns associated with glyphosate exposure. Recent court rulings and settlements have significant implications for the glyphosate market, influencing public perception, regulatory decisions, and corporate strategies. Companies operating in the glyphosate market are closely monitoring legal developments and implementing risk management measures to address potential liabilities.