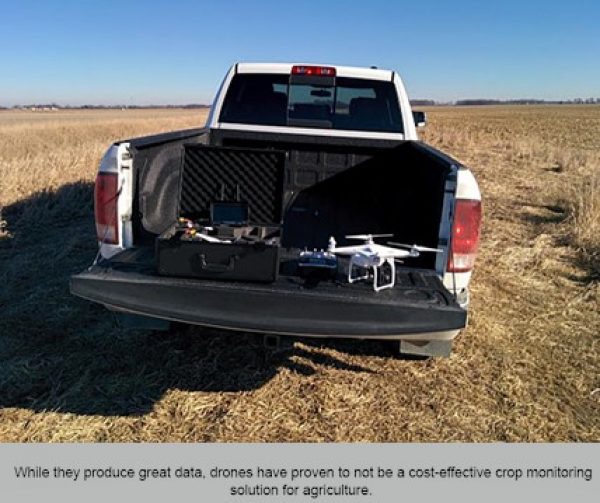

The drone revolution died in the back of a truck

InfoAg is a who’s who of digital agriculture. Each year, TerrAvion makes a point of conducting a survey to understand the state of the ag IT market with a particular emphasis on the remote sensing market. We systematically talk to clients, prospects, competitors, alternatives, as well as unrelated and complementary service providers. Also, we discuss the market in our scheduled meetings around InfoAg. We are posting our key findings here in the spirit of sharing, correcting misconceptions, and learning with Cunningham’s Law.

Our key observations of the digital ag market are:

- Acres on digital platforms continue to grow, led by retail and input digital ag programs.

- These companies are interested in digital ag because many advanced inputs like micro-nutrients, variable rate equipment, and fungicide do not work in every situation.

- Digital ag programs drive a reduction in input tons but an increase in input dollars and margins as more advanced inputs are used in place of input quantity (e.g., required micro-nutrients instead of more NPK fertilizer).

- Sustainability and responding to consumer preferences is still nascent, but we see signs of, for retail in particular, thinking about how to respond to downstream players.

- Savvy retailers are taking an orthogonal approach to OEM and input company platforms.

- Most distribution channel organizations are using one or more supplier digital platforms with their growers (e.g., Climate, John Deere Ops Center, Xarvio, etc.).

- Most retailers are implementing, using, or thinking about a backbone that is centered around their own staff that often interacts with the input company platforms while giving the retailer proprietary insights and leverage with their suppliers.

- OEM and input suppliers do not offer the full suite of services required to run a digital agronomy program. The channel is building customized and differentiated offerings by leveraging OEM platforms and products supplemented by proprietary IT, services, and client knowledge.

- OEMs are endorsing this strategy as the pendulum swings from squeezing the distribution channel for margin to ensuring the distribution channel is viable and effective at distributing their products. There is limited and mixed follow-through on supporting distributor differentiation at the product level on input and OEM digital platforms.

As a sub-segment participant, particularly as a data provider in remote sensing, we are starting to see some shifts in the market. First, the ROI that data can provide is becoming increasingly clear. Second, imagery is viewed as the central data layer that unifies sampled, spatially incomplete, or temporally incomplete data to drive farm outcomes. Third, it is more widely understood that space-based remote sensing fails to answer key agronomic questions. Fourth, we see growth in complementary data collection such as IoT sensors and advanced sampling techniques, which include micro-biology sampling, genomics, and similar technologies.

Satellite:

- Public domain satellite consumption is increasing as Sentinel becomes a new open standard, supplanting LANDSAT. Public domain consumption remains the largest segment by acres of agricultural imagery consumption, though the data rate is low, and revenue is negligible.

- Commercial satellite consumption seems to be headed backwards with the possible exception of Granular, mostly caused by Planet licensing restrictions backlash. Airbus seems to be gaining some ground in commercial satellite. This segment has the most client spend of any segment, but it seems to be headed lower.

Aerial:

- Concurring with our observation, the press also noticed that drone consumption in agriculture is headed down. We note that many of the former drone companies have transitioned to focus on a particular form of analytics and more of them are consuming high-resolution airplane imagery as they scale in an attempt to improve economics and operational performance.

- The aerial segment is experiencing an increased level of provider consolidation and company failure. Many legacy providers like

Aeroptic/GeoVantage have wound down and some drone companies like Precision Hawk appear to have functionally exited agriculture–very few attended InfoAg as a crude measure of the drone companies’ lack of focus on the agricultural market.

Aeroptic/GeoVantage have wound down and some drone companies like Precision Hawk appear to have functionally exited agriculture–very few attended InfoAg as a crude measure of the drone companies’ lack of focus on the agricultural market. - The aerial segment is growing rapidly, >100% annually, but still only serves a small portion of total acreage. TerrAvion provides the vast majority of actual data consumption, on the order of 65%-80% of total deliveries in the segment.

- There is a lot of excitement about new sensors. [We are excited about this too! Watch this space and call us if you have needs here, we have some really cool toys in the lab.] That said, there is still a gap between promise and large-scale, reliably high ROI implementation in production. Not all of this work is done by technology providers, as some of it is done by the channel and input suppliers.

- The analytics ecosystem is developing for both satellite and aerial data providers. There are now more analytics companies than data providers–which is the expected and healthy state of the value chain. The independent analytics ecosystem seems to have overtaken proprietary analytics in terms of feature completeness as well as cost on our key benchmarks of analytics concerning water, NPK fertility, advanced fertility, equipment, weed control, and fungicide application.

In summary, digital agriculture continues to grow and generate value for clients in one of the toughest years for North American agriculture. We believe the industry is on the path to comprehensive adoption through recent high ROI agricultural technologies such as guidance systems and GM traits. We welcome feedback and media inquiries about our findings, data, and methodologies.

Source ; Terravion

Aeroptic/GeoVantage have wound down and some drone companies like Precision Hawk appear to have functionally exited agriculture–very few attended InfoAg as a crude measure of the drone companies’ lack of focus on the agricultural market.

Aeroptic/GeoVantage have wound down and some drone companies like Precision Hawk appear to have functionally exited agriculture–very few attended InfoAg as a crude measure of the drone companies’ lack of focus on the agricultural market.