Precision planting is technology-based seeding and plantation of crops that require accurate control of plant population and specific spacing between crops and along the rows. This enables better germination in contrast with the traditional planting methods. Precision planting involves the use of automation and connected technologies, including the Global Positioning System (GPS)-based guidance technology, smart metering, display systems, and variable rate technology (VRT) to manage crops and optimize the use of resources, such as seed, fertilizers, and water. These technologies are used in conjunction with on-field planting equipment and systems for accurate seed placement. The precision planting market is dominated by a few market players. Key firms in the market are acquiring small players to expand their offerings across the world. Precision planting is still comparatively expensive compared to traditional farming methods, making it unaffordable to smaller farmers in emerging economies.

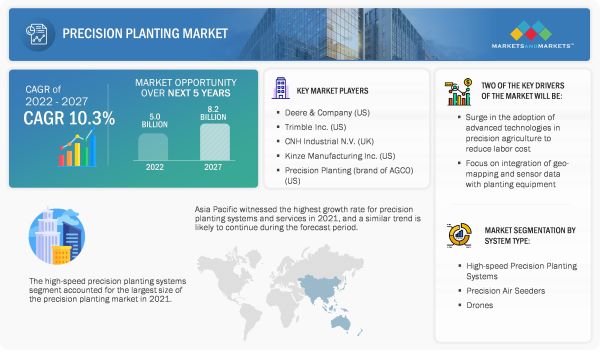

Currently, the precision planting market is expected to grow further due to the growing adoption of guidance system, IoT devices, global positioning system (GPS), and remote sensing technologies by farmers/growers. The precision planting market is expected to grow from USD 5.0 billion in 2022 to USD 8.2 billion by 2027, at a CAGR of 10.3%.

The most significant factor driving the growth of the precision planting market includes surging adoption of advanced technologies to reduce labor cost. The agriculture industry is highly dependent on laborers for different activities; however, with technological advancements, automation is replacing the task of laborers and enabling the industry players to achieve high output in less time. The adoption of advanced technologies is helping farmers to cover a large area of their fields more efficiently in lesser time. Precision planting is an advanced planting technique that involves cutting-edge technologies that enable farmers to increase productivity and minimize labor costs. The major technologies used for precision planting are smart sensors, GPS, GNSS, auto-steering and guidance technology, and variable rate technology (VRT), among others.

Electric drive systems to witness higher growth during forecast period

Drive systems help in planting seeds in a more precise manner. All the parts in a drive system must be well integrated for uniform seed placement and good planter performance. Ground and hydraulic drive systems comprise chains, sprockets, clutches, hex shafts, and bearings. A kinked chain, a slipping drive wheel, a worn-out bearing, or a failed clutch can result in poor singulation, spacing, or population. Standard drive systems are complex, made up of ~138 parts that must work together perfectly to position seeds for better yield. All the parts of planting systems need to be calibrated with each other to achieve maximum efficiency and reduced error. The planter drive systems for seeds and insecticides require yearly maintenance. Advanced electric drive systems replace all the parts with one simple electric motor on each row, minimizing the risk and maintenance during planting. Electric drive systems can be equipped with software platforms to simplify the operation of seed and insecticide meters. With electric drive systems, each meter in a planter turns at a speed that matches the speed of the row unit. With this, the plant population can be kept uniform in each curved row, and high planter performance can be achieved. In advanced drive systems, the excessive noise related to mechanical parts such as drive shafts, chains sprockets, and gears, is eliminated and power consumption is reduced as compared with conventional drive systems.

Large areas under crop cultivation and use for advanced farm technologies driving the market growth in the US

The US contributed a significant share to the precision planting market. The country has a large area for crops under cultivation; every year, more than 90 million ha are planted with row crops such as corn and soybean. High-speed precision planters are mainly used in commodity row crops in the US. As per USDA 2022 summary report, the country had 895 million acres of farmland in 2021, with an average farm size of 445 acres (Source: USDA). The adoption rate of automation and digitalization of agriculture is high in large farms, which further enables farmers in the country to make use of modern and precise equipment for agriculture. In order to produce various types of row crops, farmers practice conventional tillage and soil preparation, which involve several steps, including preparing the soil bed and eliminating weeds. These activities cannot be completed manually in a short span of time on large agricultural lands. Therefore, farmers are adopting precision planting and seeding equipment, such as precision air seeders, planting robots, and UAVs/drones.

The growing US economy and the continued policy support are expected to help the precision planting market in the country grow during the forecast period. In 2020, about 44% of the land in the country was used for crops, pastures, or grazing among other agriculture practices. In 2021, the average farm size was 445 acres. This helped farmers to adopt automated agricultural equipment and advanced technologies, such as precision planters, air drills, air carts, air seeders, Herd Broadcast Seeders, precision guidance, variable rate technology (VRT), GPS, and yield mapping for higher production and profits on large farms. The overall agriculture technology ecosystem in the US is advanced enough, with major agriculture equipment companies making significant investments in this space.

Asia Pacific likely to provide attractive opportunity in precision planting market by 2027

Asia Pacific accounted for a significant share and highest growth rate of the precision planting market in 2021. The region is an emerging market with investments from several multinational manufacturers, especially in major markets, such as Australia, Japan, and China. The projected growth rate of the Indian market for precision planting equipment is high compared with other countries in the region due to government support and a high adoption rate among farmers. There are a number of global players in the market trying to enter this region by means of mergers, acquisitions, or partnerships for business expansion. The Asia Pacific market is expected to expand at the highest growth rate due to the increasing demand from countries, such as India, Australia, Japan, and China. Key factors restraining the growth of the market in the region are the high cost of equipment and small and fragmented landholdings. Deere & Company (US), Precision Planting (US), Topcon Precision Agriculture (US), Trimble Inc. (US), and Topcon Corporation (Japan) are among the major companies operating in this region.

Key players expanding their market and geographical presence through new product launches, partnership/agreements, merger and acquisitions, and expansions

The precision planting market is consolidated with the presence of a large number of global and local market players. In 2021, Deere & Company (US), Trimble Inc. (US), CNH Industrial N.V. (UK), Kinze Manufacturing Inc. (US), and Precision Planting (brand of AGCO) (US) were the major players in the precision planting market. The combined market share of the key five companies accounted for more than 60% of the overall precision planting market.

These companies operate worldwide and are involved in developing precision planting solutions for various applications, such as row crops, vegetable crops, and forestry. They rely on their R&D capabilities and carry out significant product launches, resulting in their large market shares. Some of the other key players in this market are Topcon Positioning Systems, Inc. (US), Buhler Industries Inc. (Canada), Vaderstad Industries Inc. (Canada), Stara S/A (Brazil), Kasco Manufacturing Inc. (US), Davimac Group (Australia), Morris Industries Ltd. (Canada), SeedMaster Manufacturing Ltd. (Canada), and The Climate Corporation (US).

- TABLE 1 Precision PLANTING MARKET: key deals, 2019-2022

| Month & Year | Deal TYPE | COMPANY 1 name | company 2 name | Description |

| October 2022 | Partnership | Trimble Inc. | CLASS (Germany) | Trimble Inc. partnered with CLAAS, a leading manufacturer of agricultural machinery, to develop a next-generation precision farming system for CLAAS tractors, combines, and forage harvesters. SAT 900 GNSS receiver, GPS PILOT steering system, and the new CLAAS CEMIS 1200 ‘smart’ display are all part of the precision farming system. This display uses Trimble’s new embedded modular software architecture for positioning, steering, and ISOBUS to connect to implements in the field and control them. |

| May 2021 | Acquisition | Vaderstad AB (Sweden) | AGCO-Amity JV, LLC (AAJV) (US) | Vaderstad AB acquired the AGCO-Amity JV LLC (AAJV), a developer and distributor of air seeding and tillage equipment under the Amity, Concord, Wil-Rich, and Wishek brands. It is also known as Wil-Rich and has been integrated into the Vaderstad Group of companies under the name Vaderstad Inc. As a result of incorporating AAJV into the Vaderstad Group, Vaderstad gains access to distribution outlets and a manufacturing facility in the US as well as the heritage and reputation of Wil-Rich, Wishek, and Concord. |

| December 2020 | Partnership | Trimble Inc. | SiriusXM (US) | Trimble Inc. partnered with SiriusXM to deliver Trimble RTX GNSS corrections VIA satellite radio for autonomous vehicles. |

| November 2019 | Agreement | CNH Industrial N.V. | Deere & Company (US), DKE Agrirouter (Germany), and DataConnect (US) | CNH Industrial N.V. entered into distinct industry cooperative agreements with DataConnect, John Deere, and DKE Agriroute. With these agreements, the company aimed to provide its customers with the option of managing their fleets in a single digital platform. |