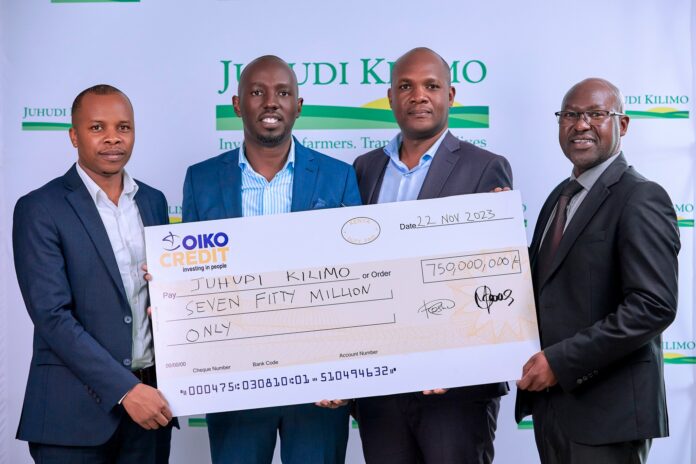

Impact investor Oikocredit, Dutch-based global cooperative has approved a five-year loan of US$ 5 million (KES 750 million) to Juhudi Kilimo, a non-deposit-taking microfinance institution (MFI) in Kenya, as part of a strategic funding agreement aimed at empowering smallholder farmers and micro enterprises in the country’s rural and periurban areas.

The agreement with Oikocredit aligns with Juhudi Kilimo’s commitment to providing customised loans and enhancing financial independence for individuals in underserved communities.

Juhudi Kilimo has an outstanding loan book of KES 2.5 billion, with more than 84 per cent dedicated to the agricultural sector. The institution was recognised by Starbrands Awards East Africa as the top microfinance provider of agricultural financing in Kenya last year.

The MFI has a track record of delivering financial inclusion. It serves more than 70,000 clients across 52 branches in 33 Kenyan counties.

Bernard Kivava, Juhudi Kilimo’s CEO, said, “This long-term funding from Oikocredit will support our strategic plan to offer affordable and accessible medium-term financing to our customers, especially in rural and periurban areas with the overreaching goals of improving livelihoods and contributing towards food security across the country.

“As we expand our touchpoints to customers through the use of new technology and by establishing new service centres and branches, we feel privileged to have access to the funds, which will enable us to serve both our existing and new customers,” he added.

Michael Kariah, Oikocredit’s Investment Officer for East and Southern Africa, said, “We are pleased to be working with Juhudi Kilimo as one of our newest long-term partners. Our missions align around supporting local communities, creating jobs and improving food security, among other social issues in the continent. We look forward to working closely with Juhudi Kilimo to make a lasting impact in these areas.”

About Oikocredit

Social impact investor and worldwide cooperative Oikocredit has nearly five decades of experience funding organisations active in financial inclusion, agriculture and renewable energy.

Oikocredit’s loans, equity investments and capacity building aim to enable people on low incomes in Africa, Asia and Latin America to improve their living standards sustainably.

Oikocredit finances more than 500 partners, with total development financing capital outstanding of € 1,037.2 million (at September 2023). For more information, visit www.oikocredit.coop

About Juhudi Kilimo

Juhudi Kilimo started in 2004 as an agriculture microlending initiative under the K-Rep Development Agency and by 2009, it had developed into an independent for-profit social enterprise with the mission to improve the livelihoods of rural smallholder farmers and micro-entrepreneurs by providing wealth-creating financial solutions.

The institution’s main focus is on financing agricultural assets and backing various value chains and business ventures that provide farmers and micro-entrepreneurs with both immediate and sustainable income through defined loan products under agriculture, business, and consumer loans. For more information, visit www.juhudikilimo.com